Gifts of Real Estate

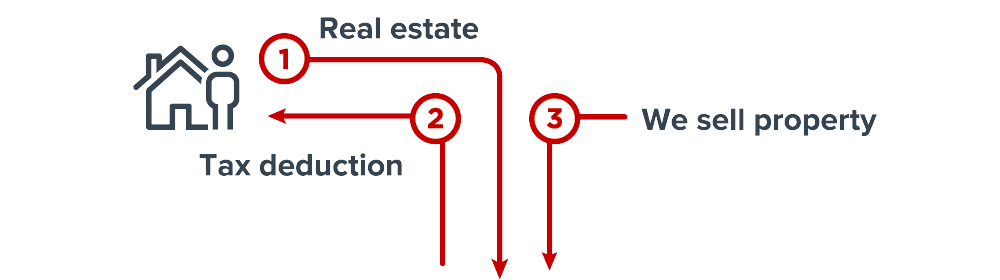

How It Works

- You deed your home, vacation home, undeveloped property, or commercial building to American Technion Society.

- You may continue to use the property rent-free, and then ownership passes to us when you no longer need it.

- American Technion Society may sell the property and use the proceeds.

Benefits

- You receive an income tax deduction for the fair market value of the real estate.

- You pay no capital gains tax on the transfer.

- Your gift can support students, faculty or outstanding research at ATS.

Next

- More details about gifts of real estate.

- Frequently asked questions on gifts of real estate.

- Contact us so we can assist you through every step.

Contact Us

Planning your estate and legacy for future generations, including your charitable interests, takes careful evaluation. Consulting with the appropriate professionals can assist you.