Deferred Gift Annuity

As a younger donor still in high-earnings years, you are still saving for retirement and also trying to lower your taxable income.

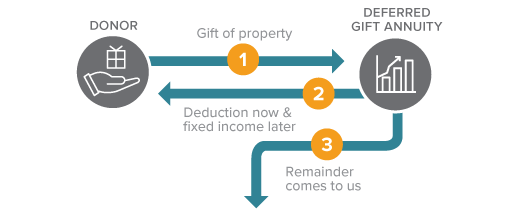

How It Works

- You transfer cash or securities. Our minimum gift requirement is $20,000.

- Beginning on a specified date in the future, you, or up to two annuitants you name began to receive fixed annuity payments for life.

- ATS recommends that you are at least age 50 to fund the gift.

- The remaining balance passes to ATS when the contract ends.

Benefits

- Deferral of payments permits a higher annuity rate and generates a larger charitable deduction.

- You can schedule your annuity payments to begin when you need extra cash flow, such as retirement years.

- Payments are guaranteed and fixed, regardless of fluctuations in the market.

- The longer you elect to defer payments, the higher your payment will be.

Next

- More details on Deferred Gift Annuities.

- Frequently asked questions on Deferred Gift Annuities.

- Contact us so we can assist you through every step.

Contact Us

Planning your estate and legacy for future generations, including your charitable interests, takes careful evaluation. Consulting with the appropriate professionals can assist you.